Queens Ny Property Tax Rate . your property tax rate is based on your tax class. the median property tax (also known as real estate tax) in queens county is $2,914.00 per year, based on a median home value of. There are four tax classes. Looking for more property tax statistics in your area? In new york city, property tax rates are actually quite low. Multiply the taxable value of your property by the current tax rate for your property's tax. — queens stats for property taxes. property taxes in new york vary greatly between new york city and the rest of the state. to estimate your annual property tax: Queens county is rank 61st. Instantly view essential data points on queens, as well. queens county (0.87%) has a 47% lower property tax rate than the average of new york (1.64%). The tax rates are listed below.

from www.armstrongeconomics.com

The tax rates are listed below. the median property tax (also known as real estate tax) in queens county is $2,914.00 per year, based on a median home value of. to estimate your annual property tax: Queens county is rank 61st. In new york city, property tax rates are actually quite low. property taxes in new york vary greatly between new york city and the rest of the state. your property tax rate is based on your tax class. Multiply the taxable value of your property by the current tax rate for your property's tax. — queens stats for property taxes. Instantly view essential data points on queens, as well.

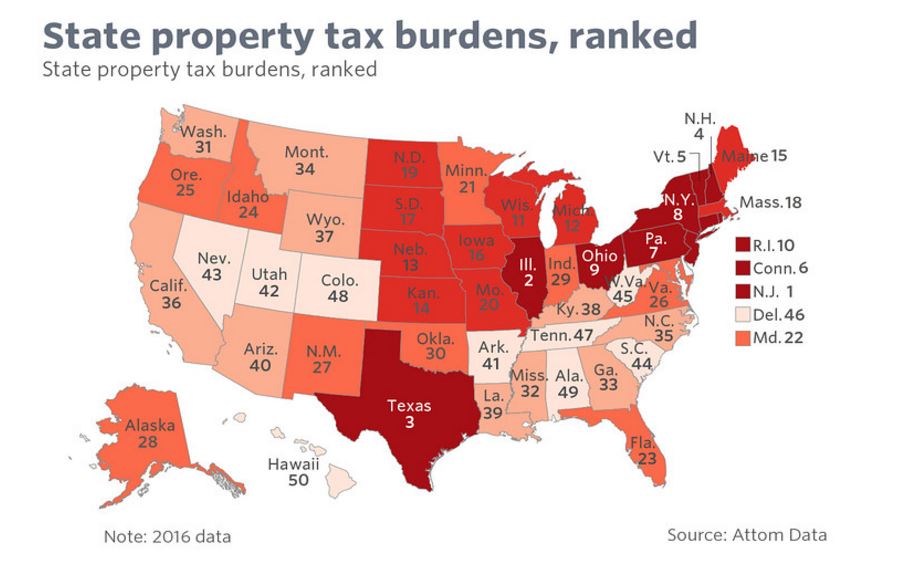

US Property Tax Comparison by State Armstrong Economics

Queens Ny Property Tax Rate Looking for more property tax statistics in your area? Instantly view essential data points on queens, as well. the median property tax (also known as real estate tax) in queens county is $2,914.00 per year, based on a median home value of. Multiply the taxable value of your property by the current tax rate for your property's tax. — queens stats for property taxes. There are four tax classes. queens county (0.87%) has a 47% lower property tax rate than the average of new york (1.64%). to estimate your annual property tax: property taxes in new york vary greatly between new york city and the rest of the state. The tax rates are listed below. your property tax rate is based on your tax class. In new york city, property tax rates are actually quite low. Looking for more property tax statistics in your area? Queens county is rank 61st.

From www.empirecenter.org

New York Property Tax Calculator 2021 Empire Center for Public Policy Queens Ny Property Tax Rate Queens county is rank 61st. The tax rates are listed below. Looking for more property tax statistics in your area? your property tax rate is based on your tax class. queens county (0.87%) has a 47% lower property tax rate than the average of new york (1.64%). Multiply the taxable value of your property by the current tax. Queens Ny Property Tax Rate.

From www.hauseit.com

NYC Property Tax Bills How to Download and Read Your Bill Queens Ny Property Tax Rate queens county (0.87%) has a 47% lower property tax rate than the average of new york (1.64%). The tax rates are listed below. There are four tax classes. Instantly view essential data points on queens, as well. Queens county is rank 61st. the median property tax (also known as real estate tax) in queens county is $2,914.00 per. Queens Ny Property Tax Rate.

From changecominon.blogspot.com

Nyc Property Tax Rate Condo change comin Queens Ny Property Tax Rate the median property tax (also known as real estate tax) in queens county is $2,914.00 per year, based on a median home value of. Multiply the taxable value of your property by the current tax rate for your property's tax. your property tax rate is based on your tax class. queens county (0.87%) has a 47% lower. Queens Ny Property Tax Rate.

From changecominon.blogspot.com

Nyc Property Tax Rates By County change comin Queens Ny Property Tax Rate your property tax rate is based on your tax class. Instantly view essential data points on queens, as well. the median property tax (also known as real estate tax) in queens county is $2,914.00 per year, based on a median home value of. The tax rates are listed below. There are four tax classes. Multiply the taxable value. Queens Ny Property Tax Rate.

From apianoplaysinanemptyroom.blogspot.com

Chicken Coop Build Homes For Sale Queens Ny Queens Ny Property Tax Rate The tax rates are listed below. Queens county is rank 61st. Instantly view essential data points on queens, as well. queens county (0.87%) has a 47% lower property tax rate than the average of new york (1.64%). Multiply the taxable value of your property by the current tax rate for your property's tax. the median property tax (also. Queens Ny Property Tax Rate.

From platinumcardbreaks.blogspot.com

Tax Attorney Queens Ny / Ny Attorney General Calls On Nyc To Halt And Reform Tax Lien Sales Queens Ny Property Tax Rate The tax rates are listed below. In new york city, property tax rates are actually quite low. Looking for more property tax statistics in your area? Queens county is rank 61st. — queens stats for property taxes. property taxes in new york vary greatly between new york city and the rest of the state. Multiply the taxable value. Queens Ny Property Tax Rate.

From itrfoundation.org

Property Tax Rate Limits ITR Foundation Queens Ny Property Tax Rate the median property tax (also known as real estate tax) in queens county is $2,914.00 per year, based on a median home value of. Queens county is rank 61st. your property tax rate is based on your tax class. There are four tax classes. Instantly view essential data points on queens, as well. The tax rates are listed. Queens Ny Property Tax Rate.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Queens Ny Property Tax Rate Instantly view essential data points on queens, as well. There are four tax classes. Multiply the taxable value of your property by the current tax rate for your property's tax. to estimate your annual property tax: — queens stats for property taxes. property taxes in new york vary greatly between new york city and the rest of. Queens Ny Property Tax Rate.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Queens Ny Property Tax Rate There are four tax classes. Instantly view essential data points on queens, as well. your property tax rate is based on your tax class. the median property tax (also known as real estate tax) in queens county is $2,914.00 per year, based on a median home value of. Looking for more property tax statistics in your area? . Queens Ny Property Tax Rate.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Queens Ny Property Tax Rate property taxes in new york vary greatly between new york city and the rest of the state. Instantly view essential data points on queens, as well. Multiply the taxable value of your property by the current tax rate for your property's tax. your property tax rate is based on your tax class. Queens county is rank 61st. . Queens Ny Property Tax Rate.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Queens Ny Property Tax Rate — queens stats for property taxes. The tax rates are listed below. queens county (0.87%) has a 47% lower property tax rate than the average of new york (1.64%). In new york city, property tax rates are actually quite low. to estimate your annual property tax: property taxes in new york vary greatly between new york. Queens Ny Property Tax Rate.

From finance.georgetown.org

Property Taxes Finance Department Queens Ny Property Tax Rate The tax rates are listed below. Queens county is rank 61st. your property tax rate is based on your tax class. Instantly view essential data points on queens, as well. In new york city, property tax rates are actually quite low. to estimate your annual property tax: Multiply the taxable value of your property by the current tax. Queens Ny Property Tax Rate.

From bobsullivan.net

Pay higherthanaverage property taxes? This map tells you (and who pays 7x the national rate Queens Ny Property Tax Rate queens county (0.87%) has a 47% lower property tax rate than the average of new york (1.64%). There are four tax classes. the median property tax (also known as real estate tax) in queens county is $2,914.00 per year, based on a median home value of. Instantly view essential data points on queens, as well. Multiply the taxable. Queens Ny Property Tax Rate.

From exovljwdw.blob.core.windows.net

What Is The Property Tax In Queens Ny at Walter Bott blog Queens Ny Property Tax Rate property taxes in new york vary greatly between new york city and the rest of the state. The tax rates are listed below. queens county (0.87%) has a 47% lower property tax rate than the average of new york (1.64%). — queens stats for property taxes. Multiply the taxable value of your property by the current tax. Queens Ny Property Tax Rate.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Queens Ny Property Tax Rate to estimate your annual property tax: — queens stats for property taxes. property taxes in new york vary greatly between new york city and the rest of the state. Looking for more property tax statistics in your area? the median property tax (also known as real estate tax) in queens county is $2,914.00 per year, based. Queens Ny Property Tax Rate.

From cbcny.org

NYC Effective Tax Rates CBCNY Queens Ny Property Tax Rate In new york city, property tax rates are actually quite low. Multiply the taxable value of your property by the current tax rate for your property's tax. your property tax rate is based on your tax class. Looking for more property tax statistics in your area? property taxes in new york vary greatly between new york city and. Queens Ny Property Tax Rate.

From changecominon.blogspot.com

Nyc Property Tax Rate 2020 change comin Queens Ny Property Tax Rate The tax rates are listed below. — queens stats for property taxes. In new york city, property tax rates are actually quite low. to estimate your annual property tax: Looking for more property tax statistics in your area? Multiply the taxable value of your property by the current tax rate for your property's tax. queens county (0.87%). Queens Ny Property Tax Rate.

From cbcny.org

New York City Property Taxes CBCNY Queens Ny Property Tax Rate — queens stats for property taxes. Queens county is rank 61st. In new york city, property tax rates are actually quite low. to estimate your annual property tax: There are four tax classes. Looking for more property tax statistics in your area? Multiply the taxable value of your property by the current tax rate for your property's tax.. Queens Ny Property Tax Rate.